The dangers to the worldwide increase outlook are “overwhelmingly tilted to the downside” and the sector may want to quickly be on the point of a recession, the International Monetary Fund’s (IMF) pinnacle economist, Pierre-Olivier Gourinchas, has warned.

“The outlook has darkened substantially because April. The global may also quickly be teetering on the brink of a international recession, simplest years after the closing one,” Gourinchas wrote on July 26 in an editorial accompanying the discharge of an replace to the IMF’s World Economic Outlook report.

In the trendy replace to its outlook report, the IMF reduce its international increase forecast for 2022 with the aid of using forty foundation factors to three.2 percentage and with the aid of using 70 foundation factors to 2.nine percentage for 2023.

While the above is the IMF’s base case, in an opportunity situation wherein a few dangers materialise – along with no deliver of Russian fueloline to Europe – international increase will fall in addition to approximately 2.6 percentage in 2022 and a couple of percentage in 2023 – stages which have been undershot simply 5 instances because 1970, Gourinchas stated.

“Under this situation, each america and the euro vicinity enjoy near-0 increase subsequent yr, with poor knock-on results for the relaxation of the sector,” he added.

The US is predicted to quickly fall into what’s colloquially referred to as a technical recession – consecutive quarters of contraction in GDP. Data launched in advance this yr confirmed americaA economic system reduced in size with the aid of using 1.6 percentage in January-March. The Federal Reserve Bank of Atlanta’s ‘GDPNow’ forecast presently estimates US GDP probably gotten smaller with the aid of using 1.6 percentage in April-June.

Inflation risk

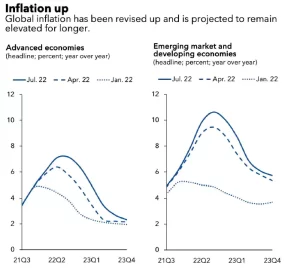

Even as increase is slowing down, the risk of excessive inflation remains, with the IMF even occurring to elevate its inflation forecast due to dangers from meals and gasoline charges.

As in keeping with the agency, international patron charge inflation is visible averaging 8.three percentage in 2022, up from the 7.four percentage forecast in April. In 2023, patron inflation is visible easing sharply to 5.7 percentage – additionally ninety foundation factors better than what changed into forecast in April.

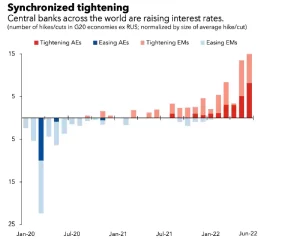

“Inflation at contemporary stages represents a clean danger for contemporary and destiny macroeconomic balance and bringing it again to principal financial institution goals need to be the pinnacle precedence for policymakers. In reaction to incoming data, principal banks of main superior economies are retreating economic assist quicker than we predicted in April, even as many in rising marketplace and growing economies had already commenced elevating hobby charges closing yr,” Gourinchas stated.

Russia’s invasion of Ukraine in overdue February disrupted components of essential commodities, pushing up charges globally. Consequently, key principal banks withinside the advanced global, along with americaA Federal Reserve, have all started tightening their economic rules in earnest to reduce down multi-decade excessive inflation.

Gourinchas stated the synchronised tightening of economic coverage throughout international locations is “unprecedented” and it might harm increase, even though that changed into a sour tablet that have to be swallowed.

“Tighter economic coverage will unavoidably have actual financial costs, however delaying it’ll simplest exacerbate the hardship. Central banks which have commenced tightening need to live the direction till inflation is tamed,” he argued.